WO2001084906A2 - Advanced asset management systems - Google Patents

Advanced asset management systems Download PDFInfo

- Publication number

- WO2001084906A2 WO2001084906A2 PCT/US2001/015283 US0115283W WO0184906A2 WO 2001084906 A2 WO2001084906 A2 WO 2001084906A2 US 0115283 W US0115283 W US 0115283W WO 0184906 A2 WO0184906 A2 WO 0184906A2

- Authority

- WO

- WIPO (PCT)

- Prior art keywords

- account

- asset management

- management system

- data

- advanced asset

- Prior art date

Links

Classifications

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q30/00—Commerce

- G06Q30/06—Buying, selling or leasing transactions

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/02—Payment architectures, schemes or protocols involving a neutral party, e.g. certification authority, notary or trusted third party [TTP]

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/02—Payment architectures, schemes or protocols involving a neutral party, e.g. certification authority, notary or trusted third party [TTP]

- G06Q20/023—Payment architectures, schemes or protocols involving a neutral party, e.g. certification authority, notary or trusted third party [TTP] the neutral party being a clearing house

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/04—Payment circuits

- G06Q20/06—Private payment circuits, e.g. involving electronic currency used among participants of a common payment scheme

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/08—Payment architectures

- G06Q20/10—Payment architectures specially adapted for electronic funds transfer [EFT] systems; specially adapted for home banking systems

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q20/00—Payment architectures, schemes or protocols

- G06Q20/38—Payment protocols; Details thereof

- G06Q20/387—Payment using discounts or coupons

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/02—Banking, e.g. interest calculation or account maintenance

Definitions

- the present invention relates to computer-based systems, processes and methods for the management of, and the transmission, transfer, receipt, aggregation, distribution, and exchange of, cash and non-cash assets.

- This invention also covers data processing: financial, business practice, management or cost/price determination.

- Paper currency retained the best attributes of coinage, which included being lightweight, transferable, bearer-owned, anonymous, and having a fixed value relative to the issuing nation.

- Receipts are gathered by identity thieves by "dumpster diving,” a practice of gleaning discarded receipts from the trash. Further, unscrupulous waiters in restaurants and others with the opportunity to directly handle these instruments can use "card skimmers,” small devices that contain a magnetic stripe reader with a small memory that stores the card numbers for later retrieval, to capture this information.

- CNP Card Not Present

- the consumer is generally subject to a maximum liability for credit card fraud of fifty dollars, which frequently is waived.

- Debit cards which may bear a credit card logo, are a simple link to an underlying account and provide the consumer no equivalent protections. Most consumers are unaware that their debit card provides little protection against fraud and that they assume the risk, not their financial institution or the merchant. Electronic checks can be created and submitted to the Automated Clearing

- the rate of identity theft and of corresponding fraudulent activity is increasing.

- the Internet has provided a global communications medium whereby a thief stealing credit card and other identity information can barter, sell, or give away that information by transmitting it to a few individuals or large groups. Those recipients may be distributed worldwide, causing an account stolen in New York City to incur fraudulent charges in Asia or Europe within minutes or hours.

- account numbers are usually well protected by encryption when transmitted from the consumer's web browser to the e-commerce server, the account numbers are frequently stored for later retrieval as part of a one-click buying process.

- the e-commerce servers retain log files of the transactions that are used for later accounting and auditing purposes.

- the account information stored on the e- commerce server or in the log files is rarely encrypted or protected.

- the merchant may be unwittingly exposing large quantities of accounts.

- News reports have documented instances of entire databases of account and identity (including name and address) information being stolen en masse, in quantities ranging from twenty-five thousand to almost a half- million accounts.

- micropayment Another technology more recently proposed is the use of various "micropayment” strategies, which allow for small transactions to be aggregated, affording the possibility of fractional cent payments for pay-per-view web browsing. Aggregation is required because the credit card system for merchants is inefficient for transactions less than $10. Likewise the infrastructure carrying cost of other back-end electronic funds transfer mechanisms would cost more, on a per transaction basis, than the value of the discrete transaction itself.

- Current micropayment initiatives work by aggregating many small transactions and submitting a final consolidated bill for later settlement through a phone, credit or ISP bill, primarily becoming a billing service rather than a form of electronic money.

- the invention comprises several general aspects. Each of those can if desired be combined with additional features, the resultant combinations representing more detailed optional embodiments of these aspects.

- an advanced asset management system which comprises a computer system having at least one data processor, at least one data storage device, and at least one communications device through which the computer system can communicate with one or more entities that can connect directly or indirectly with said computer system.

- account management software Stored in said computer system on said at least one data storage device is account management software for storing and managing one or more accounts, accessible at least in part via said at least one communications device.

- At least a portion of said one or more accounts respectively comprise at least one token(s), and optionally one or more additional token(s) stored in the computer system. These token(s) are symbols through said one or more accounts is/are recognizable by the system.

- the first mentioned token(s) affords at least one account of said one or more accounts to be recognizable by the system in communications between the system and said entities.

- the system further comprises data and/or code through which the system recognizes said one or more accounts, or said one or more sub-accounts thereof upon receipt, via said at least one communication device, of said at least one token or said one or more additional tokens.

- the account(s) stored in the computer system comprise one or more account(s), one or more direct or indirect sub-accounts(s) thereof, and token(s) thereof.

- One or more entities other than account administrators, including persons, organizations and/or other computer systems, owning or having control of said account(s) or at least a portion of the content thereof, and, optionally, one or more third party entities, can manipulate said account(s).

- the advanced asset management system comprises a plurality of computer systems.

- the advanced asset management system comprises data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating an account(s).

- said at least one data processor of the advanced asset management system may if desired be configured to accept one or more commands to perform these functions only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said account(s).

- the advanced asset management system comprises data and/or code for permitting access to an account(s).

- said at least one communications device of the advanced asset management system may if desired be configured to permit access to an account(s) based on receipt via said at least one communications device of a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities having authorization to access an account(s).

- the advanced asset management system comprises data and/or code for managing one or more predetermined types of transactions in or with said account(s).

- said at least one storage device of the advanced asset management system contains an historical record(s) pertaining to one or more completed transaction(s) of said account(s).

- the advanced asset management system has storage device(s) which contain(s) historical record(s) pertaining to one or more completed and/or to one or more failed transactions of said account(s).

- the account(s) of the advanced asset management system may comprise a savings account(s), a checking account(s), a money-market account(s), an unsecured line of credit account(s), a secured line of credit account(s), a securities account(s), a virtual account(s), a financial institution account(s), a non- financial institution account(s), a currency-based account(s), and/or a non-currency- based account(s).

- said virtual account(s) at least one private token, stored in said computer system, that is/are a confidential symbol(s) through which said virtual account(s) is/are recognizable by the system, at least one public token, stored in said computer system, that is/are a symbol(s) through which at least one primary public sub-account of said virtual account(s) is/are recognizable by the system in communications between the system and an entity/entities, and optionally, one or more additional public tokens, stored in the computer system, through which one or more additional direct and/or indirect public sub-accounts of said virtual account(s) is/are recognizable by the system in communications between the system and an entity/entities.

- the system further comprises data and/or code though which the system to recognizes said virtual account(s) or said one or more public sub- accounts thereof upon receipt, via said at least one communications device, of said at least one public token or said one or more additional public tokens without receipt of said at least one private token, and prevents said entities from obtaining said at least one private token via said at least one communications device.

- said virtual account(s) comprises a private token(s), through which the virtual account(s) is/are recognizable by the system, at least one primary public sub-account, recognizable by the system through a first public token(s), and one or more public sub-accounts, subordinate to said primary account(s), each recognizable by the system through its own public token(s).

- ownership or control of said account(s) is: anonymous, in that no information, or insufficient information, for signifying such ownership or control, is stored by the system; identified, in that sufficient information for identifying such ownership or control is stored by the system; and/or identified, but with its true identity masked, in that the information stored in the system disguises such ownership or control.

- the advanced asset management system further comprises data and/or code for managing, respectively, said anonymous, identified, and/or masked account(s).

- the advanced asset management system comprises a plurality of account(s) in which ownership or control of a given account(s) differs from at least one other account(s) as to whether said account(s) are anonymous, identified, and/or masked.

- the advanced asset management system comprises a plurality of account(s) in which the system comprises data and/or code for managing accounts wherein the ownership or control of a given account(s) differ(s) from at least one other account as to whether said account(s) are anonymous, identified, and/or masked.

- the advanced asset management system may comprise data and/or code that cause(s) the system to recognize one or more logical connections between accounts. These connections can be between accounts, between sub-accounts, from an account(s) to a sub-account(s), and/or from a sub-account(s) to an account(s).

- the first mentioned account(s) in each of the foregoing types of combinations of accounts may be anonymous, identified, or identified, but with their true identity masked, to the account(s) connected to them.

- the advanced asset management system may comprise data and/or code that will, notwithstanding receipt via said communications device(s) of a token(s) for a particular account(s), withhold disclosure of all information, or disclosure at least a portion of the information, concerning the account(s).

- the information may pertain to the ownership or control of said account(s), the content of said account(s), the logical connection(s) in which said account(s) are involved, any transactions in which said account(s) is/are involved, and/or any transaction historyhistories in which said account(s) have been involved.

- the system comprises data and/or code that will establish and/or dissolve one or more continuing, or temporary expiring, logical connections between accounts in which an account(s), serving as a parent account(s) to one or more accounts subordinate thereto, may be anonymous, identified, and/or masked with respect to said subordinate account(s).

- the parent account(s) differ(s) in its/their relationships to at least two subordinate accounts as to whether the parent account(s) is/are anonymous, identified, and/or masked with respect to said subordinate accounts.

- the system comprises data and/or code that will establish and/or dissolve one or more continuing, or temporary expiring, logical connections between accounts in which an account(s), subordinate to one or more accounts serving as parent accounts thereto, may be anonymous, identified, and/or masked with respect to said parent account(s).

- the subordinate account(s) differ(s) in its/their relationships to at least two parent accounts as to whether the subordinate account(s) is/are anonymous, identified, and/or masked with respect to said parent accounts.

- the advanced asset management system may comprise data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more domains.

- said at least one data processor of the advanced asset management system may if desired be configured to accept one or more commands to perform these desired functions only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said domain(s).

- each sub-account of an account is assigned to one or more domains, or to a particular domain, and said code and/or data is configured to execute a given command or combination of commands that is applicable to and manipulates, as a group, all sub-accounts in at least one selected domain or all sub-accounts of said account, h still another particular form of this embodiment, all sub-accounts of an account represented by private tokens are assigned to one or more private domains, or to a particular private domain, said private domain(s) being restricted to sub-accounts represented by private tokens, and wherein said code and/or data is configured to execute a given command or combination of commands that is applicable to and manipulates, as a group, all sub- accounts represented by private tokens within said account.

- all sub-accounts of an account represented by public tokens are assigned to one or more public domains, or to a particular public domain, said public domain(s) being restricted to sub-accounts represented by public tokens, and wherein said code and/or data is configured to execute a given command or combination of commands that is applicable to and manipulates, as a group, all sub- accounts represented by public tokens within said account.

- the advanced asset management system comprises means for encrypting an account(s). In other embodiments, the advanced asset management system comprises means for encrypting of all or at least a portion of any information about the account(s) that is: stored by the system, processed by the system, and/or communicated to or from the system. In certain forms of the preceding embodiments, the information may pertain to, at least in part, the ownership or control of said account(s), at least a portion of the content of said account(s), the logical connection(s) of said account(s), the transactions involving said account(s), and the transaction histories in which said account(s) has have been involved.

- the advanced asset management system may have a computer system comprising data and/or code that manages actual or potential connection(s), through one or more first communications devices in said system, directly or indirectly, with one or more second communications devices outside said computer system, that can transmit a token(s) to said computer system, or receive a token from said computer system, whereby said second communications device(s) can participate in interactions with said account(s).

- the advanced asset management system may have a computer system comprising data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more account repositories, said repository/repositories containing one or more accounts.

- said at least one data processor of the advanced asset management system may if desired be configured to accept one or more commands to perform these functions only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said repository/repositories.

- the advanced asset management system may comprise any number of account repositories respectively comprising one or more accounts and may have one or more actual or potential communications connections with one or more other repositories comprising one or more accounts, with one or more additional commumcations devices, or with both, said connection/connections thereby affording the opportunity for interactions within or between said repository/repositories, and/or their respective account(s).

- said repository/repositories may represent an open group and may not be subject to any restriction(s) against an interaction(s) with either one or more other repositories or their respective account(s), or with one or more communications devices.

- said repository/repositories represent a controlled group subject to one or more restrictions against an interaction(s) with one or more repositories and/or their respective account(s) outside of said group, or against a specific type(s) of interaction(s) with one or more repositories and/or their respective account(s), or against an interaction(s) with other than approved communications device(s).

- the restrictio ⁇ (s) to the controlled group may be dynamically selected and applied, based on data received via said communications device(s).

- the last mentioned restriction(s) may be enforced or abrogated based on the character of, and in response to receipt of, a PIN(s), password(s) or other authenticating token(s).

- repositories representing a distributed group(s) having controlling software and/or hardware programmed with information identifying, and comprising a communications route(s) 5 to, the other repositories in said group(s).

- repositories representing a federated group(s) having controlling software and/or hardware programmed with information identifying each of the other repositories in the group(s), and with code that represents a condition of trust with respect to transactions within and between repositories in said group(s).

- repositories representing a distributed-federated group(s) having controlling software and/or hardware programmed with information identifying each of the other repositories in the group(s), communications route(s) to the other repositories in the group(s), and code that represents a condition of trust with respect to transactions within and 5 between repositories in said group(s).

- the embodiments of the invention are advanced asset management systems wherein there is a plurality of said repositories 0 that exist in an inter-networked group(s) and in which all of the following conditions exist: the other repositories are not required to be known in advance, but can be discovered; communications connections between the repositories are not required to be known in advance, but can be discovered; routes between repositories in said group(s) are not required to be known in advance, but can be determined; routes between repositories in said group(s) can change, with no requirement that subsequent communications connections between said repository and said other repositories, established after a first communications connection between said repository and said other repositories, must traverse the same path as said first communications connection; communications connections between said repository and said other repositories can be dynamically established, dissolved, moved, managed, and redirected; and connections between repositories are either intermittent or permanent.

- the invention also includes embodiments of advanced asset management systems wherein there is a plurality of said repositories that exist

- a first repository containing at least one account, that is programmed to communicate and conduct transactions as an independent repository or as a member of a given group of repositories, may also be programmed to communicate with, and to conduct transactions with, at least one other repository not comprised in said given group.

- said first repository is not comprised in any group of repositories, is a member of a distributed group, is a member of a federated group, is a member of a distributed- federated group, or is a member of an inter-networked group.

- said at least one other repository is not comprised in any group of repositories, is a member of a second group of distributed repositories, is a member of a second group of federated repositories, is a member of a second group of distributed-federated repositories group, or is a member of a second group of inter- networked repositories.

- the advanced asset management system further comprises means for encrypting the repository/repositories and its/their comprised account(s). In other embodiments, the advanced asset management system comprises means for encrypting all or at least a portion of any information regarding said repository/repositories and its/their comprised account(s): stored by, processed by, and/or communicated to or from, said advanced asset management system.

- a virtual clearinghouse system can act as a third party intermediary for facilitating transactions in which the transaction participants respectively comprise a first participant which is at least one virtual account or a sub-account(s) thereof, and a second participant which is at least one participant other than said at least one virtual account or sub-account(s) thereof.

- the clearinghouse system comprises a computer system having at least one data processor, at least one data storage device, and at least one communications device through which the computer system can communicate with one or more entities that can connect directly or indirectly with said computer system.

- the account repository connection requests respectively comprise data representing at least one account transaction, comprising such information as is required to characterize the transaction, at least one address for a given repository/repositories in which the participating account(s) is/are situated, and at least one public token(s) of a participating account(s).

- the system further comprises data and/or code that represents the existence of a direct or indirect trusting relationship between the clearinghouse system and said repository/repositories, and between the clearinghouse and the second participant.

- the data and/or code is also configured to establish, accept, coordinate, and/or otherwise manipulate direct or indirect trusted connections via said at least one communications device between the repository/repositories and at least one of said entity/entities, with which the second participant may be directly or indirectly associated or which may be the second participant, and transmits the transaction information, whereby the participants can conduct transactions with each other without requiring a direct trusting relationship between the participants.

- 4.1.2.2 [Claims 173-184]

- the virtual clearinghouse system comprises a plurality of computer systems.

- the virtual clearinghouse system comprises data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more virtual clearinghouses, components thereof, and/or communication requests thereof.

- said at least one data processor of the virtual clearinghouse system may if desired be configured to accept one or more commands to perform these functions only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control, respectively, said one or more virtual clearinghouses, said components thereof, and/or said communication requests thereof.

- the virtual clearinghouse system comprises data and/or code for permitting access to one or more virtual clearinghouses, components thereof, and/or communication requests thereof.

- said at least one communications device of the virtual clearinghouse system may if desired be configured to permit access to one or more virtual clearinghouses, components thereof, and/or communication requests thereof, based on receipt via said at least one communications device of a PIN(s), ⁇ assword(s) or other authenticating token(s) signifying an entity/entities having authorization to access, respectively, said one or more virtual clearinghouses, said components thereof, and/or said communication requests thereof.

- the virtual clearinghouse system may comprise data and/or code that cause(s) said clearinghouse system to act as a third party intermediary for facilitating one or more

- the virtual clearinghouse system may comprise data and/or code that cause(s) said clearinghouse system to act as an agent for one or more repositories.

- the virtual clearinghouse system may comprise data and/or code for calculating, collecting, disbursing, reporting, and/or otherwise manipulating taxes and/or fees, or information pertaining to at least in part taxes and/or fees.

- the virtual clearinghouse system may comprise data and/or code for granting, revoking, reporting, validating, transmitting and/or otherwise manipulating credentials and/or licenses, or information pertaining to at least in part credentials and/or licenses.

- the virtual clearinghouse system may comprise data and/or code for granting, revoking, authenticating, validating, transmitting and/or otherwise manipulating one or more digital security certificates, or information pertaining to at least in part digital security certificates.

- the virtual clearinghouse system may comprise data and/or code for granting, revoking, authenticating, validating, transmitting and/or otherwise manipulating one or more digital signatures, or information pertaining to at least in part digital signatures.

- said at least one data processor is configured to accept one or more commands to perform any one of the functions previously described in this paragraph only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to confrol the function and/or the object thereof.

- the virtual clearinghouse system second participant may be at least one other account in the same repository/repositories in which the first participant is situated.

- the virtual clearinghouse system second participant is at least one other account in a repository other than said given repository/repositories.

- the virtual clearinghouse system second participant is not a virtual account or sub-account thereof.

- the virtual clearinghouse system comprises means for encrypting the clearinghouse(s). In other embodiments, the virtual clearinghouse system comprises means for encrypting all or at least a portion of any information 5 about account(s) and participant(s) that is: stored by, processed by, and/or communicated to or from, the system(s).

- the encrypted information may pertain at least in part to the ownership or confrol of said account(s), at least a portion of the content of said account(s), a logical connection(s) of an account(s), a transaction(s) involving an account(s), and a o transaction history/histories in which an account(s) has/have been involved.

- a virtual naming system which comprises a computer system having at least one data processor, at 5 least one data storage device, and at least one communications device through which the computer system can communicate with one or more entities that can connect with said computer system.

- naming system software Stored in said computer system on said at least one data storage device is naming system software for creating, storing, maintaining, and/or otherwise manipulating data comprising at least one name and at least one address for 0 each of a plurality of repositories, said data being at least in part accessible via said at least one communications device.

- Said naming system further comprises data and/or code that creates, stores, maintains, and/or otherwise manipulates a list(s) of known repositories and repository addresses.

- Said naming system allows one or more entities other than naming system administrators, including persons, organizations, 5 and/or other computer systems, owning or having control of an account(s) in one or more repositories or at least a portion of the content of an account(s) in one or more repositories, and, optionally, one or more third party entities, to locate and discover a communication route(s) to such repository/repositories without knowing the name or without knowing the address thereof.

- 4.1.3.2 [Claims 243-261] included among the embodiments of the invention are those in which the virtual naming system comprises a plurality of computer systems.

- the virtual naming system comprises data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more naming systems and/or list(s) thereof.

- Said list(s) may comprise: known repositories, repository addresses, aliases for said repositories, repository ownership certificates, known clearinghouses, clearinghouse addresses, aliases for said clearinghouses, clearinghouse ownership certificates, known labeling systems, labeling system addresses, aliases for said labeling systems, labeling system ownership certificates, other known naming systems, other naming system addresses, aliases for said other naming systems, naming system ownership certificates, known devices, device addresses, aliases for said devices, and/or device ownership certificates.

- said at least one data processor of the virtual naming system may if desired be configured to accept one or more commands to perform these functions only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control, respectively, said one or more virtual naming systems and/or said list(s) thereof.

- the virtual naming system comprises data and/or code for permitting access to one or more virtual naming systems and/or list(s) thereof.

- said at least one communications device of the virtual naming system may if desired be configured to permit access to one or more virtual naming systems and/or list(s) thereof based on receipt via said at least one communications device of a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities having authorization to access, respectively, said one or more virtual naming systems and/or said list(s) thereof.

- the virtual naming system comprises means for encrypting the naming system(s). In other embodiments, the virtual naming system comprises means for encrypting all or at least a portion of any information regarding said naming system(s) and its/their comprised list(s): stored by, processed by, and/or communicated to or from, said naming system(s).

- the advanced asset management system comprises data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating at least a portion of the content of an account(s).

- said at least one data processor of the advanced asset management system may if desired be configured to accept one or more commands to perform these functions only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said account(s).

- the advanced asset management system comprises means for encrypting a first and second part of the at least a portion of the content of an account(s) independently from one another.

- the advanced asset management system comprises means for encrypting the at least a portion of the content of an account(s), and storing, processing, and/or communicating said encrypted portion without requiring that said encrypted portion be decrypted

- the at least a portion of the content within the advanced asset management system is an asset(s), and in certain forms of this embodiment the content may be a digital asset(s), qualitative information about a digital asset(s), information other than qualitative information about a digital asset(s), a representation of a digital asset(s), qualitative information about a representation of a digital asset(s), information other than qualitative information about a representation of a digital asset(s), a representation of a non- digital asset(s), qualitative information about a representation of a non-digital asset(s), or information other than qualitative information about a representation of a non- digital asset(s).

- the system may be adapted to effect transfer of ownership or control of at least a portion of the asset(s) reflected in the account(s) from one or more entities to one or more other entities, whereby the transfer does not require either physical manifestation or physical transfer of the asset(s) itself/themselves.

- the advanced asset management system may comprise data and/or code that comprise(s) conversion routine(s) which interact with a record(s) of a given type(s) of asset(s) stored in one or more accounts by said system and with information about any qualitative and/or quantitative relationship(s) between an asset(s) of said given type(s) and of other type(s) of asset(s) and that is able, on command, after receipt of a token(s) for said account(s), to convert the record(s) of said given type(s) of asset(s), at least in part, to at least one record(s) of at least one of said other type(s) of asset(s).

- the advanced asset management system may comprise data and/or code that, on command, after receipt of a token(s) for said account(s), cause(s) at least a portion of the asset(s) held within an account(s) to be reserved for future use, thus chmmishing the current available balance by the amount placed on reserve, without debiting the account(s).

- the account(s) reflect information concerning the value of a given asset(s), expressed as a particular quantity of said asset(s) in particular units, which units may optionally be monetary units, and the system comprises data and/or code that, on command, expresses a quantity of units present in the account(s) when the particular quantity is converted to a resulting number of different units, said number of different units being of equivalent value to said particular quantity of said particular units.

- the advanced asset management system may comprise one or more provisions for storing and manipulating data with respect to a plurality of different types of assets. These different types of assets may in some cases differ from one another in their primary function or quality.

- an account(s) may store assets of a first type, and of at least one other type, different from said first type.

- said first asset type may be a given form of currency, the currency of a given national and/or multi-national jurisdiction, a tangible or intangible non- monetary thing of measurable quantity and of measurable value, a tangible or intangible non-monetary thing of measurable quantity but of no intrinsic value, a tangible or intangible non-monetary thing of no measurable quantity but of measurable value, or a tangible or intangible non-monetary thing of no measurable quantity and of no intrinsic value.

- said first type and said at least one other type of assets may differ in that they are different currencies, different currencies of different national and/or multinational jurisdictions, different tangible or intangible non-monetary things of measurable quantity and of measurable value, different tangible or intangible non- monetary things of measurable quantity but of no intrinsic value, different tangible or intangible non-monetary things of no measurable quantity but of measurable value, or different tangible or intangible non-monetary things of no measurable quantity and of no intrinsic value.

- the advanced asset management system may comprise provisions for incrementing, validating, expiring, decrementing, and/or otherwise manipulating a tangible or intangible non-monetary asset of measurable quantity.

- the advanced asset management system may comprise means for entering into and/or removing from an account(s) tangible or intangible non-monetary asset(s) of no measurable quantity.

- the advanced asset management system may comprise means for recording in an account(s), or prohibiting an account(s) from containing, an asset(s) in a particular form of currency, an asset(s) in the currency of a particular national and/or multi-national jurisdiction, a particular tangible or intangible non-monetary asset(s) of measurable value, a particular tangible or intangible non-monetary asset(s) of measurable quantity but no measurable value, and/or a particular tangible or intangible non-monetary asset(s) of no measurable quantity.

- 4.1.4.6 [Claims 315-318]

- the advanced asset management system further comprises data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, 5 generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more attributes.

- said at least one data processor of the advanced asset management system may if desired be configured to accept one or more commands to perform these functions only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other o authenticating token(s) signifying an entity/entities owning or having a right to control said one or more attributes.

- the advanced asset management system comprises data and/or code for permitting access to one or more attributes.

- said at least one communications device of the advanced asset management system may if desired be configured to permit access to 5 one or more attributes based on receipt via said at least one communications device of a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities having authorization to access said one or more attributes.

- the attributes are user-defined, in 0 that the system affords sole control over the constitution of one or more said user- defined attributes of, on, and/or within said account(s), and/or at least a portion of the content thereof, to an entity/entities owning or having a right to confrol said account(s).

- the attributes are user-selectable, in that the system generates a list(s) of attributes of, on, and/or within said account(s), and/or at least a 5 portion of the content thereof, from which an entity/entities owning or having a right to control said account(s) may select and apply one or more of said user-selectable attributes.

- the attributes are user-determinable, in that the value(s) for an attribute(s) of, on, and/or within said account(s), and/or at least a portion of the content thereof, is not preset, but is determined, within limits, by an entity/entities 0 owning or having a right to control said account(s).

- the attributes may be: of, for, and/or within at least one repository or group of repositories; of, for, and/or within at least one account or group of accounts; of, for, and/or within at least a portion of the content contained within at least one repository or group of repositories; and/or of, for, and/or within at least a portion of the content contained within at least one account or group of accounts.

- the advanced asset management system further comprises data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more constraints.

- said at least one data processor of the advanced asset management system may if desired be configured to accept one or more commands to perform these functions only if said command(s) is/are received in conjunction with a PLN(s), or other authenticating token(s) signifying an entity/entities owning or having a right to control said one or more constraints.

- the advanced asset management system comprises data and/or code for permitting access to one or more constraints.

- said at least one communications device of the advanced asset management system may if desired be configured to permit access to one or more constraints based on receipt via said at least one communications device of a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities having authorization to access said one or more constraints.

- the consfraints are user-defined, in that the system affords sole control over the constitution of one or more said user- defined constraints on said account(s), and/or at least a portion of the content thereof, to an entity/entities owning or having a right to control said account(s).

- the constraints are user-selectable, in that the system generates a list(s) of constraints on said account(s), and/or at least a portion of the content thereof, from which an entity/entities owning or having a right to confrol said account(s) may select and apply one or more of said user-selectable constraints

- the constraints are user-determinable, in that the value(s) for a constraint(s) on said account(s), and/or at least a portion of the content thereof, is not preset, but is determined, within limits, by an entity/entities owning or having a right to control said account(s).

- constraints may be: on at least one repository or group of repositories; on at least one account or group of accounts; on at least a portion of the content contained within at least one repository or group of repositories; on at least a portion of the content contained within at least one account or group of accounts; and/or on at least one attribute or group of attributes.

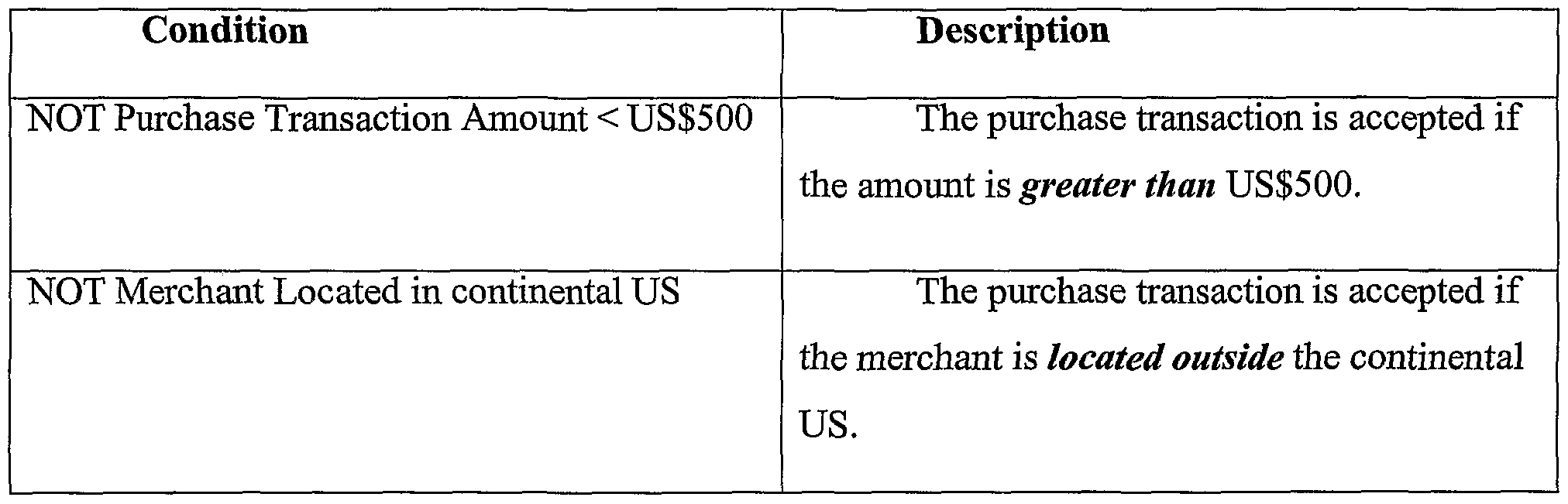

- the advanced asset management system additionally comprises at least one repository, and data and/or code for combining, by using any one or more of the Boolean logic operators AND, OR, XOR (exclusive OR), and/or NOT (inverse or complement), and/or by using any combination of the same or different operators AND, OR, XOR, and/or NOT, and/or by using one or more standard mathematical procedures for grouping and/or ordering of precedence, two or more consfraints on all or at least a portion of any repository/repositories, and/or content held within or controlled by a repository/repositories, and/or account(s) contained within or managed by a repository/repositories, and/or content held within or controlled by an account(s), and/or attributes of a repository/repositories, and/or attributes of content held within or controlled by a repository/repositories, and/or attributes of an account(s), and/or attributes of content held within or controlled by an account(s).

- said one or more consfraints exists/exist as an integral part(s), or external to, or as integral part(s) of and also external to, one or more of the following: a repository/repositories, an account(s), a repository/repositories containing an account(s), content of a repository/repositories, a repository/repositories containing or controlling said content, content of an account(s), an account(s) containing or controlling said content, an attribute(s), a repository/repositories containing an attribute(s), a repository/repositories containing an account(s) containing an attribute(s), an account(s) containing an attribute(s), content of an account(s).

- said data and/or code includes provisions for processing and/or evaluating said constraint(s) internal to the system, for cooperating with means external to the system for external processing and/or evaluating of said constraint(s), or both of the preceding, with respect to one or more of the following: a repository/repositories, an account(s), a repository/repositories containing an account(s), content of a repository/repositories, a repository/repositories containing or controlling said content, content of an account(s), an account(s) containing or controlling said content, an attribute(s), a repository/repositories containing an attribute(s), a repository/repositories containing an account(s) containing an attribute(s), an account(s) containing an attribute(s), content of an account(s).

- the advanced asset management system may comprise an inter-networked group of repositories, a distributed-federated group of repositories, a distributed group of repositories, a federated group of repositories, and/or at least one repository, and said system may comprise, or have access to through at least one communications device(s), data and/or code comprising one or more constraint(s) on an inter-networked group of repositories, a distributed-federated group of repositories, a distributed group of repositories, a federated group of repositories, or at least one repository, wherein said constraint(s) constitute a set(s) of rules or controls applicable at least in part to one or more: repositories, accounts therein, portions of the content of said repositories, portions of the content of said accounts, attributes of said repositories, attributes of said accounts, and/or attributes of said portions of the content of said accounts or of said repositories.

- the advanced asset management system may comprise, or have access to through at least one communications device(s), data and/or code comprising one or more constraint(s) on an at least one account wherein said constraint(s) constitute a set of rules or controls applicable at least in part to one or more: of said accounts, portions of the content of said accounts, attributes of said accounts, and/or attributes of said portions of the content of said accounts.

- said constraint(s) on a distributed-federated group of repositories may be an extension or augmentation of rules or controls applicable to a larger inter-networked group of repositories with which said distributed-federated group of repositories interacts, wherein said consfraint(s) are not less restrictive than the consfraint(s) applicable to the larger inter-networked group of repositories.

- said constraint(s) on a distributed group of repositories may be an extension or augmentation of rules or controls applicable to a larger inter-networked group and/or a larger distributed-federated group of repositories with which said distributed group of repositories interacts, wherein said consfraint(s) are not less restrictive than the consfraint(s) applicable respectively to the larger inter-networked group of repositories or the larger distributed-federated group of repositories, respectively.

- said constraint(s) on a federated group of repositories may be an extension or augmentation of rules or controls applicable to a larger inter-networked group of repositories and/or a larger distributed-federated group of repositories with which said federated group of repositories interacts, wherein said constraints) are not less restrictive than the consfraint(s) applicable respectively to the larger inter-networked group of repositories or the larger distributed-federated group of repositories, respectively.

- said constraints) on an at least one repository may be an extension or augmentation of rules or controls applicable to a larger inter-networked group of repositories and/or a larger distributed-federated group of repositories, and/or a larger distributed group of repositories, and/or a larger federated group of repositories with which said repository interacts, wherein said constraint(s) are not less restrictive than the constraint(s) applicable respectively to the larger inter-networked group of repositories, the larger distributed-federated group of repositories, the larger distributed group of repositories, or the larger federated group of repositories, respectively.

- said consfraint(s) on at least one account maybe an extension or augmentation of rules or controls applicable to an inter- networked group ofrepositori.es and/or a distributed-federated group of repositories, and/or a distributed group of repositories, and/or a federated group of repositories, and/or an individual repository with which said account(s) interact(s), wherein said constraint(s) are not less restrictive than the consfraint(s) applicable respectively to the inter-networked group of repositories, the distributed-federated group of repositories, the distributed group of repositories, the federated group of repositories, or the individual repository.

- the invention includes further refinements of each of said embodiments wherein said data and/or code includes provisions for storing and/or processing all or at least a portion of any information, regarding said one or more consfraints internal to the system, and provisions for cooperating with means external to the system, for external storing and/or processing of all or at least a portion of any information, regarding a constraint(s), or both of the preceding, comprising means for encrypting all or at least a portion of any information so stored and/or processed.

- said data and/or code includes provisions for communicating all or at least a portion of any information regarding said one or more constraints to or from the system, comprising means for encrypting all or at least a portion of any information so communicated.

- the advanced asset management system may comprise at least one repository and at least one communications channel, between said at least one communications device and said at least one repository, between at least two communications devices, and/or between at least two repositories, wherein said at least one communications channel is/are a public network(s), a private network(s), a private-over-public network(s) or some combination of public, private, and/or private- over-public network(s).

- one or more clearinghouses may act(s) as an intermediary/intermediaries between said device(s) and said repository/repositories, between said devices, and or between said repository/repositories.

- the advanced asset management system may comprise data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more constraints, restricting or granting access to a particular communications channel(s) and/or sub-component(s) thereof.

- said at least one data processor of the advanced asset management system may, if desired be configured to accept one or more commands to perform these steps only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said consfraint(s).

- the advanced asset management system may comprise data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more sub-account(s), wherein said sub-account(s) is/are the primary account(s) within a particular domain(s).

- the advanced asset management system may comprise one or more primary account(s), and data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more sub-account(s), wherein said sub-account(s) is/are related, but subordinate to, said primary account(s).

- the advanced asset management system may comprise one or more first sub-account(s), and data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more other sub-account(s), wherein said other sub-account(s) is/are related, but subordinate to, said first sub-account(s).

- the advanced asset management system data processor(s) may, if desired, be configured to accept one or more commands to perform the foregoing steps only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said primary account(s) and/or said sub-account(s), respectively.

- a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said primary account(s) and/or said sub-account(s), respectively.

- the token(s) for any account(s) may be dynamically generated.

- said dynamic generation may be performed on request, wherein said request is made by an authorized entity/entities.

- the advanced asset management system data processor(s) may, if desired, be configured to accept one or more commands to perform the foregoing dynamic generation only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said account(s).

- the advanced asset management system has provisions for maintaining the account(s) in a hierarchy, said hierarchy having one or more levels wherein at least one account is the head of each level so maintained.

- the hierarchies can have: zero, one or more additional accounts subordinate to said at least one account serving as the head account; and zero, one or more branches per level.

- each branch may spawn a hierarchy independent of any hierarchy spawned by any other branch at its/their level or at any other level, and wherein all said spawned hierarchies are subordinate hierarchies to the hierarchy containing said branches.

- the advanced asset management system may comprise one or more provision(s) for activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more classes of said one or more sub-accounts.

- the advanced asset management system may comprise one or more provision(s) for the preceding functions for a plurality of classes of said one or more sub-accounts that differ from one another in their primary function or quality.

- said one or more sub-accounts may comprise a first sub- account(s) and at least one other sub-account(s) of a class/classes different than, or of the same class/classes as, said first sub-account(s).

- Said one or more classes of said one or more sub-accounts may comprise: a child account(s), a peer account(s), an escrow account(s), a bid account(s), a gaming account(s), and a proxy account(s).

- An escrow account(s) may include an obligation account(s), a credit account(s), and a reserve account(s), representing sub-classes of escrow account(s).

- the proxy account may be dynamically generated.

- the advanced asset management system may comprise data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more bid pools, and/or one or more gaming/gambling pools.

- said at least one data processor of the advanced asset management system may, if desired, be configured to accept one or more commands to perform these step(s) only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control, respectively, said bid pool(s), and/or said gaming/gambling pool(s).

- the advanced asset management system may comprise data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more labels for one or more accounts.

- the advanced asset management system data processor(s) may, if desired, be configured to accept one or more commands to perform these step(s) to create, implement, modify, deactivate, destroy, evaluate, and/or otherwise manipulate a label(s) only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to confrol said account(s).

- the label(s) is/are dynamically generated.

- the advanced asset management system may comprise data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more domain constraint pools, wherein said domain constraint pool(s) contain(s) the set of all allowed attributes that may be contained within or used by: one or more account(s), and/or at least a portion of the content of said account(s); and the set of all allowed constraints that may be used by or on: one or more account(s), at least a portion of the content of said account(s), one or more attributes of said account(s), and/or one or more attributes of said portion of the content of said account(s), and wherein said account(s) is/are located within the domain(s) governed by said one or more domain constraint pools.

- the advanced asset management system said at least one data processor may, if desired, be configured to accept one or more commands to perform these step(s) only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said one or more domain constraint pools.

- said domain constraint ⁇ ool(s) contain(s) an allowed range of values and/or limit(s) for each constraint(s) and/or for each attribute(s) included therein.

- the advanced asset management system may comprise data and/or code which is responsive to the submission to the system of a PIN(s), password(s) or other authenticating token(s), including at least the public token(s) of a primary and/or subordinate account(s) in a virtual account domain, for making available to a submitting entity one or more command functions, exercisable by the submitting entity, for activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more attribute(s) of, in, or on a domain constraint pool or group of domain constraint pools.

- the advanced asset management system may comprise data and/or code which is responsive to the submission to the system of a PIN(s), password(s) or other authenticating token(s), including at least the public token(s) of a primary and/or subordinate account(s) in a virtual account domain, for making available to a submitting entity command functions, exercisable by the submitting entity, for activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more constraint(s) on a domain constraint pool or group of domain constraint pools.

- the advanced asset management system may comprise data and/or code which is responsive to the submission to the system of a PIN(s), password(s) or other authenticating token(s), including at least the public token(s) of a primary and/or subordinate account(s) in a virtual account domain, for making available to a submitting entity one or more command functions, exercisable by the submitting entity, for establishing one or more accounts.

- the advanced asset management system may comprise data and/or code which is responsive to the submission to the system of a PIN(s), password(s) or other authenticating token(s), including at least the public token(s) of a primary and/or subordinate account(s) in a virtual account domain, for making available to a submitting entity one or more command functions, exercisable by the submitting entity, for transferring the content of, or at least a portion(s) of the content of, one or more accounts, to one or more other account(s).

- a PIN(s), password(s) or other authenticating token(s) including at least the public token(s) of a primary and/or subordinate account(s) in a virtual account domain, for making available to a submitting entity one or more command functions, exercisable by the submitting entity, for transferring the content of, or at least a portion(s) of the content of, one or more accounts, to one or more other account(s).

- the advanced asset management system may comprise data and/or code which is responsive to the submission to the system of a PIN(s), password(s) or other authenticating token(s), including at least the public token(s) of a primary and/or subordinate account(s) in a virtual account domain, for making available to a submitting entity command functions, exercisable by the submitting entity, for closing one or more accounts.

- a PIN(s), password(s) or other authenticating token(s) including at least the public token(s) of a primary and/or subordinate account(s) in a virtual account domain, for making available to a submitting entity command functions, exercisable by the submitting entity, for closing one or more accounts.

- the advanced asset management system may comprise data and/or code which is responsive to the submission to the system of a PIN(s), password(s) or other authenticating token(s), including at least the public 5 token(s) of a primary and/or subordinate account(s) in a virtual account domain(s), for making available to a submitting entity one or more command functions, exercisable by the submitting entity, for changing the type of a subordinate account from one type to another.

- the advanced asset management system may comprise data and/or code responsive to the submission to the system of a PIN(s), password(s) or other authenticating token(s), including at least the public token(s) of a primary and/or subordinate account(s) in a virtual account domain(s), for making available to a submitting entity one or more command functions, exercisable by the submitting 5 entity, for the transfer of one or more subordinate accounts from at least one parent account within its/their domain(s) to at least one other parent account within its/their domain(s), and/or the transfer of one or more accounts to a domain(s) other than its/their domain(s).

- said transfer includes the transfer of all content of said transferred account(s).

- said transfer includes the transfer of all account(s) subordinate to said transferred account(s).

- the advanced asset management system may comprise data and/or code which is responsive to the submission to the system of a PIN(s), 5 password(s) or other authenticating token(s), including at least the public token(s) of a primary and/or subordinate account(s) in a virtual account domain(s), for making available to a submitting entity a plurality of command functions.

- the advanced asset management system may comprise 0 data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating: one or more alerts; one or more agents; and/or one or more triggers.

- the advanced asset management system data processor(s) may, if desired, be configured to accept one or more commands to perform these steps only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control, respectively, said alert(s), said agent(s), and/or said trigger(s).

- a virtual labeling system which comprises a computer system having at least one data processor, at least one data storage device, and at least one communications device through which the computer system can communicate with one or more entities that can connect with said computer system.

- labeling system software Stored in said computer system on said at least one data storage device is labeling system software for storing and managing data comprising at least one label for one or more accounts, said data being at least in part accessible via said at least one communications device.

- the labeling system further comprises data and/or code that creates, stores, maintains and/or otherwise manipulates one or more lists of account aliases which differ from existing public and private tokens of said accounts, and of known labels, including all aliases and all public and private token of said accounts, and ensures the uniqueness of at least all active labels among said known labels throughout all repositories with which it communicates.

- Said labels respectively comprise data that is one or more symbols generated by the system or by an entity/entities having ownership or confrol of said account(s).

- One or more entities other than labeling system administrators including persons, organizations and/or other computer systems, owning or having control of an account(s), and, optionally, one or more third party entities, can locate and communicate with such accounts without knowing the public token(s) for said accounts.

- entities other than labeling system administrators including persons, organizations and/or other computer systems, owning or having control of an account(s), and, optionally, one or more third party entities, can locate and communicate with such accounts without knowing the public token(s) for said accounts.

- the virtual labeling system comprises a plurality of computer systems.

- the virtual labeling system comprises data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, desfroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating one or more virtual labeling systems, list(s) thereof, and/or label(s) thereof,

- said at least one data processor of the virtual labeling system may if desired be configured to accept one or more commands to perform these functions only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control, respectively, one or more virtual labeling systems, list(s) thereof, and/or label(s) thereof.

- the virtual labeling system comprises data and/or code for permitting access to one or more virtual labeling systems, list(s) thereof, and/or label(s) thereof.

- said at least one communications device of the virtual labeling system may if desired be configured to permit access to one or more virtual labeling systems, list(s) thereof, and/or label(s) thereof based on receipt via said at least one communications device of a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities having authorization to access, respectively, said one or more virtual labeling systems, list(s) thereof, and/or label(s) thereof.

- the virtual labeling system may comprise data and/or code for ensuring the uniqueness of all labels in said labeling system and all other labeling systems throughout all said repositories with which said system(s) communicate(s).

- said symbol(s) is/are random in nature.

- said symbol(s) is/are non-random in nature.

- the virtual labeling system may comprise data and/or code for selecting said symbol(s) in a random manner.

- the virtual labeling system may comprise data and/or code for performing at least one of the steps of activating, authenticating, creating, deactivating, destroying, evaluating, generating, implementing, maintaining, modifying, processing, registering, and/or otherwise manipulating: one or more label directories comprising a plurality of published account labels; one or more digital certificates or list(s) thereof; and/or one or more digital signatures or list(s) thereof.

- the virtual labeling system data processor(s) may, if desired, be configured to accept one or more commands to perform these step(s) only if said command(s) is/are received in conjunction with a PIN(s), password(s) or other authenticating token(s) signifying an entity/entities owning or having a right to control said one or more virtual labeling systems and/or said list(s) thereof.

- the labeling system(s) may be encrypted.

- Other respective embodiments include virtual labeling systems further comprising means for encrypting all or at least a portion of any information regarding said labeling system(s) and its/their comprised list(s): stored by, processed by, and/or communicated to or from, said labeling system(s).

- Another aspect of the invention is a general method for managing and utilizing virtual accounts. It comprises providing a computer system having at least one data processor, at least one data storage device and at least one communications device through which the computer system can communicate with one or more entities that can connect directly or indirectly with said computer system. This method includes maintaining in said computer system on at least said one data storage device, data and/or code with respect to at least one virtual account and, optionally, with respect to one or more direct and/or indirect sub-accounts thereof.

- Such data and/or code comprises at least one private token that is a confidential symbol(s) through which the virtual account(s) is/are recognizable by the system, at least one public token that is a symbol(s) through which the virtual account(s) is/are recognizable by the system in communications via one or more of the communications device(s) between the system and said entity/entities and, optionally, one or more additional public tokens through which said one or more direct or indirect sub-accounts are recognizable in communications via said at least one communications device between the system and said entity/entities.

- one or more of said accounts are manipulated, via said at least one communications device, using said at least one public token or said one or more additional public tokens, and without furnishing said at least one private token of the virtual account(s) and said entity/entities is/are prevented from obtaining the private token(s) via said at least one communications device, and wherein the account(s) stored in said computer system comprise one or more virtual account(s), one or more direct or indirect public sub-accounts thereof, and token(s) thereof.

- the manipulating of the account(s) includes conducting fransactions in which said account(s) is/are credited and/or debited with respect to amounts of assets transmitted via the communications device(s).

- data is maintained in the system and said data is/are an asset(s).

- the asset(s) may be, respectively, a digital asset(s) and/or qualitative information about a digital asset(s) and/or information other than qualitative information about a digital asset(s) and/or a re ⁇ resentation(s) of a digital asset(s) and/or qualitative information about a representation(s) of a digital asset(s) and/or information other than qualitative information about a representation(s) of a digital asset(s) and/or a representations) of a non-digital asset(s) and/or qualitative information about a representation(s) of a non-digital asset(s) and/or information other than qualitative information about a representation(s) of a non-digital asset(s).

- 4.2.1.3 [Claims 677-700]

- all or at least of portion of the software in the system is encrypted and maintained in encrypted form throughout is storage in the system, throughout processing of data in the system, and/or throughout communication of data to and from the system.

- Another aspect of the invention includes a method for transferring assets. It comprises providing a computer system having at least one data processor, at least one data storage device and at least one communications device through which the computer system can communicate with one or more entities that can connect directly or indirectly with said computer system.

- the computer system thus provided further includes virtual account data stored on said at least one data storage device.